With household spending and the cost of living at the centre of the federal budget, 9news.com.au and Joel Gibson are helping bust the budgets of Aussie families.No matter how tight your budget might be, more often than not, there is some wiggle room for savings.Finance author Joel Gibson is an expert at finding the hidden savings in a family's weekly bills.That's exactly what he did for this family of four.

Erin's mortgage repayment is her biggest weekly cost. (Getty)Erin*, 35, lives with her husband and two young daughters in Sydney's south and the couple work hard to give their children everything they need – and it comes at a huge cost.The family's average weekly spending amounts to $2521.Of course, a huge chunk of this is their mortgage repayments.Erin and her husband also pay a lot to have their kids at daycare, which allows them both to work full-time to keep up with these payments.After taking a look at Erin's bills, Gibson found that loyalty could really work on her side.He recommended shopping around for other insurance policies, energy plans and telco plans, as years of sticking with the same company could mean plenty of savings elsewhere.If that doesn't work, he also says Erin can threaten to switch to other brands in a bid to get better deals, particularly when it comes to her mortgage.

Joel says shopping around electricity companies can save hundreds per year. (Getty Images/iStockphoto)

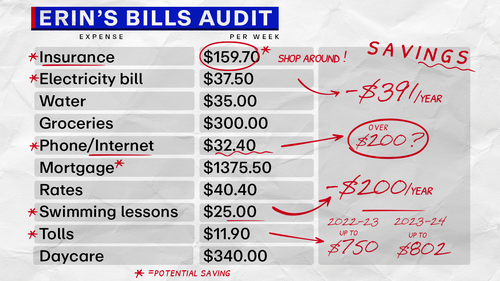

We had Gibson take a look at the family's weekly bills and he provided some helpful tips for slashing some of their costs.

- Mortgage: $5777 per month, $1375.50 per week

- Rates: $2100 per annum, $40.40 per week

- Electricity: $450 a quarter -$37.5 per week

- Water: $450 a quarter, $35 per week

- Home insurance: $1875 per annum, $36 per week

- Contents insurance: $666 per annum, $12.80 per week

- Car insurance: $1829 per annum, $35.20 per week

- Health insurance: $318 per month, $75.70 per week

- Groceries: $300

- Internet: $80 per month, $20 per week

- Phone: $58 per month, $12.40 per week

- Subscriptions: $70 per month, $16.60 per week

- Car rego: $520 per annum, $10 per week

- Daycare: $680 a fortnight, $340 per week

- Petrol: $50

- Gym: $87

- Swimming lessons: $25

- Tolls: $50 per month, $11.90 per week

All up, Erin's weekly bills amount to $2521 per week.

Car and home insurance: Save thousands – potentially

"Insurance is a big bill – when you add up their home, contents and car cover it's over $4350 a year," Gibson said."It's also going up faster than any other bill right now: the ABS says the average increase in the past year was 16 per cent. If that happens this year they'll be paying over $5000."The good news is, they've been with NRMA for 18 years on car insurance and five years on home insurance."He said loyalty could work in their favour, as the longer you're with a company, the more likely it is you could nab a better deal."That's because of 'price walking', where insurers hike up the premiums of loyal customers year after year," Gibson revealed."For example, I recently helped someone who had been a NRMA customer for over 20 years to save 54 per cent on her car insurance."So I'd get quotes from brands such as Budget Direct, Youi and Suncorp."Call them, tell them you're looking at switching three policies, email them the renewal slips and ask what's the best deal they can do."

Joel Gibson found thousands in potential savings per year for this family. (Supplied)

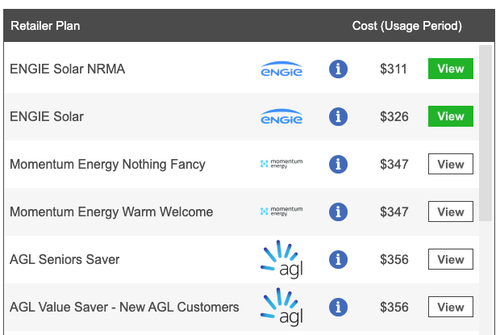

Energy: Save over $500 per year

for every household in this year's federal budget, Gibson said there are still major savings to be had."There's a box on the front page of their power bill that says 'based on your past usage, our Flexi Plan (Home) may cost you up to $391 less per year than your current plan'," Gibson notes."This 'better offer message' is now mandated in most states – retailers have to tell you if you're on their cheapest plan."The problem is: it looks like they switched away from that cheaper plan back in February – and the one they're now on is costing them more!"Joel recommends asking their provider whether it's better to go back to the old plan.But they can save even more if they're prepared to move, he said.A search on the solar plan comparison site Wattever shows that a few retailers currently have cheaper solar plans for them to the tune of over $500 a year.

Gibson recommends using Wattever for comparing energy plans. (Supplied)

Telco: Save over $200

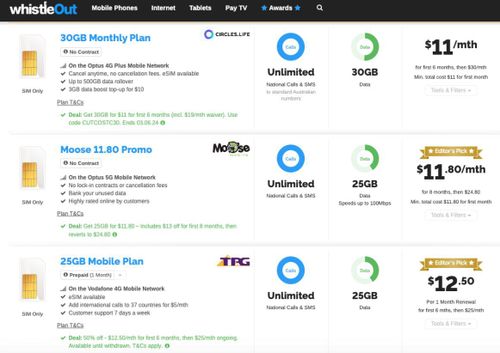

"Her Aldi Mobile plan includes 25GB per month for $29 and is one of the cheapest around on the Telstra network," Gibson said."There are potential savings, though, by switching to the Optus or Vodafone networks."A range of providers are offering similar prices to the Aldi plan plus 50 per cent or more off for 6-8 months, as this search at the Whistleout telco comparison site shows below."Erin said their internet speed isn't exactly ideal at the moment, so the family might want to switch out."They're also paying $80/month for standard-speed NBN from Vodafone. Plans at the same speed start around $60 for the first six months, rising to around $80 after that," Gibson added."But they're unhappy with their internet performance so it might also be worth looking into 5G home internet, which starts around $50 then goes to $65 after six months."

Other telco plans with cheaper monthly costs. (Supplied)

Swimming lessons: Save up to $200 per year

"Some health funds, including Erin's, allow you to claim back up to around $200 per year for swimming lessons as part of your policy, so check if it's included in yours," Gibson said.

Toll relief: Save up to $800 per year

Anyone in NSW who hasn't yet checked if they're eligible for a toll rebate can do so at the Service NSW website.Eligible motorists can claim a 40 per cent rebate up to $750 in the 2022-23 financial year and up to $802 in the 2023-24 financial year. Claims for the 2022-23 financial year close soon on June 30, 2024.

Mortgage: You never know

"An interest rate of 6.14 per cent is pretty good but there are rates out there as low as 5.80 per cent," Gibson explained."A good start is always to call your lender, tell them about some lower rates you've seen, and ask if they can match it."An example of an email or phone call is: "Hi, my name is _______ and I've been a customer for ______ years. I've just noticed my interest rate is 6.14 per cent p.a. and there are now rates out there of 5.90 per cent p.a. with CBA and Reduce Home Loans. So I'm looking at switching – but I just thought I'd make one call to see if you can match it before I request a mortgage discharge form. What's the best rate you can offer me to stay?"Joel Gibson is the author of EASY MONEY, and a money-saving expert on TikTok, TODAY, 2GB, and ABC Radio.The information provided on this website is general in nature only and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information on this website you should consider the appropriateness of the information having regard to your objectives, financial situation and needs.*Not her real name