DeepSeek caused a chain reaction of chaos on financial markets. (Getty Images: SOPA Images)

When China's first foray into artificial intelligence roared into the public domain, it dealt a blow straight to the financial heartland of the United States.

Billions of dollars were wiped off Wall Street in less than 24 hours after Chinese startup DeepSeek cast clouds of uncertainty over investors.

At the eye of the share market storm was Nvidia, a darling of the New York Stock Exchange whose cutting-edge chips have powered the AI revolution.

The storm eased just as quickly as it hit, and the days that followed proved the market ructions were short-lived.

What it left behind would form the basis of a new AI climate altogether.

From market darling to victim of record fall

Nvidia's technological prowess had supercharged the American company and made it one of the world's three most valuable at the end of 2024.

It had spent much of the year comfortably jostling with Microsoft and Apple for the title, and was regularly behind Wall Street's setting — and re-setting — of record highs.

In the eyes of investors, the chipmaker was the quintessential American success story, at the forefront of the next chapter of the technological revolution.

Many considered Nvidia the closest stock to resembling a sure thing.

But during the Monday trading session on Wall Street, that belief seemed to waver.

Nvidia has been one of the strongest performing companies on Wall Street. (Reuters: Andrew Kelly)

By the time the closing bell rang less than 7 hours later, Nvidia had lost almost $1 trillion in market value.

It even managed to set a record in the process, with a 17 per cent fall in its share price bestowing it the honour of having the biggest loss on a single day in the history of the US stock market.

A day later, Nvidia had regained ground. By the end of the week, it was business as usual.

But DeepSeek's arrival had an even deeper impact — and its launch signalled that the global AI race was about to go into overdrive.

DeepSeek and the 4-minute mile

It may have only made headlines recently, but the business is the product of years of quiet work behind the scenes.

DeepSeek was founded by 40-year-old AI entrepreneur Liang Wenfeng, who was behind the launch of High-Flyer in 2015, a quantitative hedge fund.

He has been described by AI expert and University of New South Wales engineering professor Toby Walsh as a "Chinese Sam Altman" — the founder of OpenAI — but without the charisma.

Who is Liang Wenfeng, the founder of AI company DeepSeek?

Photo shows Two men sitting on a table speaking.

High-Flyer had hired young, smart PhD graduates for its algorithmic trading, and after apologising to investors for its underperformance in 2021, Liang seemingly changed tack.

He founded DeepSeek in 2023 and his staff pivoted to creating an AI chatbot using chips from US company Nvidia.

To do that, however, the company had to think outside the square — a year earlier, the US government banned Nvidia from selling its most advanced AI processors to Chinese customers to protect the country's industry-leading status.

It meant DeepSeek had to rely on H800 Nvidia chips to develop its technology instead of the newer, faster and more expensive alternative, the H100.

"Many people in the US had thought that's going to be enough to tie their hands behind their backs and prevent them from being able to build the state-of-the-art models. And it turned out they were wrong," Professor Walsh said.

"By being resourceful in writing the software, they were able to use these not-as-powerful chips with not as much memory to be able to build a state-of-the-art model."

Nvidia has developed cutting-edge chips that have seen it dominate the AI revolution. (Reuters: Ann Wang)

That goes a way to explaining why DeepSeek made its mark, Professor Walsh said, why a small, under-resourced Chinese firm was able to create something on par with the most expensive tech in the world.

"The US tech giants aren't going to be necessarily the winners," he said.

In the last couple of years, every model has been an order of magnitude more expensive, using more data to build.

"DeepSeek demonstrates that you can do it with an order of magnitude less compute if you're smart and you know how to write the algorithms.

"It's like when someone first ran a 4-minute mile. Suddenly, lots of people were then able to do it once we realised it was technically possible."

DeepSeek is the first AI assistant developed by a Chinese-based company. (Reuters: Dado Ruvic)

It's all in the timing

DeepSeek may have become a recognisable name after rattling Wall Street, but the company's AI chatbot launched in December with little fanfare.

Its release to the public was accompanied by a paper explaining how it was created with a small budget of $US6 million ($9.66 million) and old Nvidia chips.

The chipmaker hardly moved then, and nor did it respond when DeepSeek's latest version was released almost a fortnight ago.

But come Monday, financial markets had a panic attack.

Nvidia's stock took a 17 per cent hit in response to DeepSeek. (Johnathan Raa/NurPhoto via Getty Images)

It's still not clear what set it off, but there are two main schools of thought.

It could have been as simple as DeepSeek's sudden domination of the downloads chart on Apple's app store.

The other is that the market was reacting to a note published by AI investor and analyst Jeffery Emmanuel making the case for shorting Nvidia stock, and was shared by some heavy-hitting venture capitalists and hedge fund founders.

In the post, Mr Emmanuel dissected the AI landscape and dug deep into other companies such as Groq — not to be confused with Elon Musk's Grok — and Cerebras, which have already created different chip technologies to rival Nvidia.

"At a high level, Nvidia faces an unprecedented convergence of competitive threats that make its premium valuation increasingly difficult to justify at 20 times forward sales and 75 per cent gross margins," he wrote.

"Perhaps most devastating is DeepSeek's recent efficiency breakthrough, achieving comparable model performance at approximately 1/45th the compute cost. This suggests the entire industry has been massively over-provisioning compute resources."

Is China's DeepSeek the end of AI supremacy for the US?

Photo shows The Deepseek logo and the Chinese flag are seen in this illustration.

In a live interview on X on Wednesday with Bankless HQ, Mr Emmanuel said while the market expected progress, "they expect it to be somewhat predictable".

But his analysis exposed the speed at which other companies were successfully creating fast and reliable chips for AI training and inference — and no-one had quite grasped that, he said, until he pointed it out.

"Imagine creating an air conditioner that was three times more energy efficient — you would get huge market share," he said.

"It's not just DeepSeek. People were ignoring a lot of these other threats and I don't know why, these are people whose full-time job is to cover Nvidia for Goldman Sachs and Morgan Stanley …

"How come they weren't talking about [these] competitive threats? They certainly didn't figure out this is going to be really important."

Chinese cynicism and cyber concerns

As quickly as it had launched, scepticism about DeepSeek's ability to create an AI chatbot that required less time, money and energy followed.

What is DeepSeek? Why the AI startup is up-ending the US stock market

Photo shows A phone with DeepSeek on it. Behind it is a screen with ChatGPT

Rabobank senior market strategist Benjamin Picton noted that while the lower-cost AI platform had "set the proverbial cat amongst the pigeons", its claims had naturally attracted questions.

"A number of analysts have already suggested that the claimed costs for training the model are likely bogus, and that it is very likely that DeepSeek has in fact relied on US chips that it wasn't supposed to have and may not be able to access in the future," he wrote on Tuesday.

Its country of origin would also attract cynicism, he said, referring to the software as "ChatCCP" — a moniker combining rival chatbot ChatGPT and the Chinese Communist Party.

"Certainly the funnelling of chat prompts and user details back to Chinese servers to be perused by the Chinese government is likely to be a cause for concern in national security circles," Mr Picton said.

Separate concerns have been raised about DeepSeek's censorship, with The Guardian reporting that the platform appeared to censor itself when asked about the Tiananmen Square massacre in 1989 and why Chinese President Xi Jinping is compared to Winnie the Pooh.

Those who have used DeepSeek have noticed it self-censors when asked certain questions about China. (Reuters: Florence Lo)

DeepSeek's security measures have also attracted attention since the company was targeted in a large-scale cyber attack on Tuesday.

The startup hasn't been forthcoming with details about the incident, but cybersecurity researcher Aras Nazarovas has suggested it may have been a distributed denial of service (DDoS) attack.

"AI companies are relatively susceptible to DDoS, as generating responses for AI prompts takes a lot of server resources," he said.

"[DeepSeek's] move to limit new user registrations hints at efforts to prevent its systems from being overwhelmed or further exploited by such attacks."

The rapid pace of the platform's development might have created "weak spots", Mr Nazarovas said, while its use of older hardware could also be a factor.

"From a cybersecurity perspective, DeepSeek's reliance on less-advanced chips is a strategic vulnerability," he added.

"Given the ongoing geopolitical tensions, especially between the US and China, companies that use less advanced hardware to comply with export controls risk exposing themselves to attacks from both nation-state actors and skilled cybercriminals."

No groups have claimed responsibility for the attack publicly, and there is no suggestion that state actors from the US or China were involved.

Taiwan's chip domination the real prize in East-West divide

Photo shows A microchip.

Adding to the geopolitical tension are the chips themselves, which are manufactured in Taiwan based on Nvidia's designs.

On Friday, Bloomberg reported that the US was investigating whether DeepSeek purchased advanced Nvidia chips through third parties in Singapore to get around the sales restrictions.

It followed a separate report that Microsoft and OpenAI were investigating whether a group linked to DeepSeek had improperly obtained OpenAI data.

OpenAI is also subject to several lawsuits, with the tech company accused of illegally using copyrighted work to train its systems, which it denies.

DeepSeek has not commented on either of the Bloomberg reports.

The end of the AI bubble?

Analysts and armchair investors alike questioned the sustainability of the AI-powered financial market boom, even before DeepSeek unsettled markets.

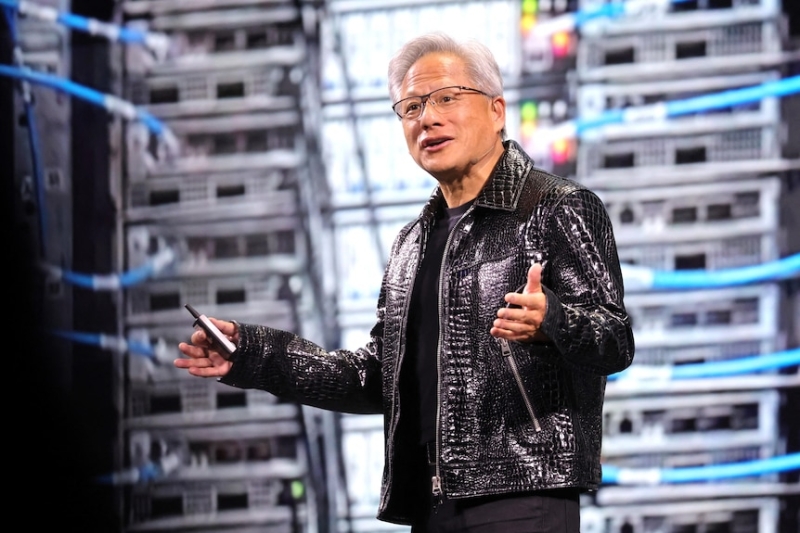

But at a tech conference in Las Vegas in early January, Nvidia CEO Jensen Huang poured fuel on the fire by unveiling a suite of new products, ranging from gaming chips to a desktop computer, an AI model to train robots and self-driving cars.

Nvidia CEO Jensen Huang announced the innovations in front of a crowd of thousands. (Reuters: Steve Marcus)

His optimism mirrored how investors had long felt about the company. In their view, Nvidia holds the keys to the technology that will shape the future, and they want to reap the financial rewards that come with being a monopoly — pushing its share price just shy of $US150.

But Roger Montgomery, the chief investment officer at Montgomery Investment Management, said investors were naive to think Nvidia would remain unchallenged.

"I think it's wrong for any investor or any CEO to believe that competition won't emerge," he said.

"History is replete with the emergence of new technologies and yet, in many instances, it's the consumer that ends up the winner, not the investors in the new technology.

"This could be another demonstration of that."

DeepSeek is powered by older — and cheaper — Nvidia chips. (Reuters: Dado Ruvic)

Investors have since returned to Nvidia and other AI-linked tech companies, with some analysts taking stock of what it means for future opportunities in the sector.

"I think that the initial market reaction was overblown," Armina Rosenberg from Minotaur Capital told The Business on Wednesday.

"What DeepSeek has proven is if you reduce costs, you're going to see a magnitude increase in people wanting to use that technology."

Ms Rosenberg said the shock and subsequent rally of tech stocks on Wall Street could be a positive development, after the value of AI-linked companies saw months of exponential growth.

"I think in some cases, valuations have run far ahead of itself, and that's particularly in the US," she said.

"When it's come back, it gives people an opportunity to participate in those AI names at more reasonable valuations.

"I also think you're going to see the breadth extend. People have gotten a little bit more enthused about the software names that are linked to AI, and also some of the power infrastructure names that link to AI as well.

"So I think that the tech rout is probably a positive because it kind of lets the market take a breather before we continue on the next leg with the journey with AI."

A wide-open innovation race

While DeepSeek is still a newer player in the competitive AI space, it has paved the way for rapid advances in the technology.

Its arrival into the public domain came days after US President Donald Trump announced a $US500 billion AI innovation project known as Stargate, but even he could see the benefits of DeepSeek, telling reporters it was a "positive" development that showed there was a "much less expensive method" available.

"The release of DeepSeek AI from a Chinese company should be a wake-up call for our industries, that we need to be laser-focused on competing to win," he said.

"That could be very much a positive development. Instead of spending billions and billions, you'll spend less and you'll come up with, hopefully, the same solution."

A 'wake-up call' from China threatens America's AI vision

Photo shows A while logo next to the word 'DeepSeek' on a phone screen sitting on top of a keyboard.

Australia's former ambassador to the United States, Arthur Sinodinos, said DeepSeek's emergence was a timely reminder for not just the president, but the country's tech giants.

"It's not all in Donald Trump's court," he told The Business on Tuesday.

"The Chinese have made it clear that in a number of these high-tech areas, they're going to be investing very strongly. They want to get the lead in AI, in quantum, in many of these areas, which they see, rightly, as the foundations of future industries.

"But the point is, it's a reminder that the playing field is a lot more complex than just the US thinking it can dictate to the rest of the world."

Economist and author Shaun Rein believes DeepSeek will lead to an explosion of AI advances, but he wants to see innovation balanced with regulation.

"I think that you're going to see over the next six to 12 months, there's going to be a bevy of new emergence of models," he told The Radio National Hour.

"They can be good for humanity, but they can also be very dangerous because of censorship.

"I actually think governments need to come in and say, 'We need to have guardrails, we need to have better regulation.'

"Because right now, it's all being led by capitalists who are trying to make a buck."