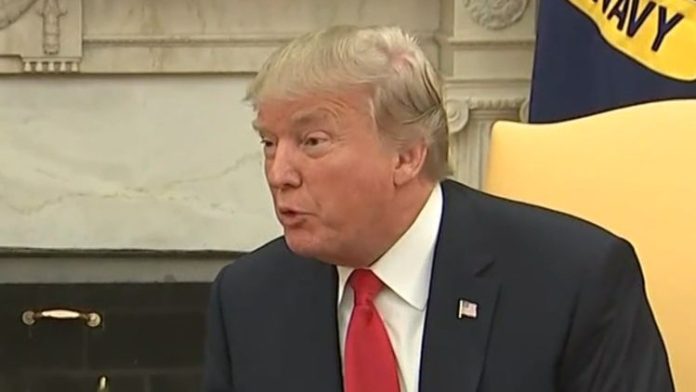

Australian shares dipped sharply in early trading today following a turbulent day on Wall Street amid increasing concern the Trump administration's tariffs will trigger a global recession.More than $30 billion was wiped off the ASX when it opened 101.6 points, or 1.3 per cent lower at 10.15am. The Sydney Morning Herald. The fall put the ASX at a seven-month low.The gloomy opening followed the US stock market's sell-off on Monday (Tuesday AEDT) as Wall Street questioned how much pain President Donald Trump is willing for the economy to endure in order to get what he wants.

Stock markets across the world are fearing a global recession is closer. (Nicolas Walker)The S&P 500 dropped 2.7 per cent to drag it close to 9 per cent below its all-time high, which was set just last month. At one point, the S&P 500 was down 3.6 per cent and on track for its worst day since 2022. That's when the highest inflation in generations was shredding budgets and raising worries about a possible recession that ultimately never came.The Dow Jones Industrial Average dropped 890 points, or 2.1 per cent, after paring an earlier loss of more than 1,100, while the Nasdaq composite skidded by 4 per cent.It was the worst day yet in a scary stretch where the S&P 500 has swung more than 1 per cent, up or down, seven times in eight days because of Trump's on -and- off -again tariffs. The worry is that the whipsaw moves will either hurt the economy directly or create enough uncertainty to drive US companies and consumers into an economy-freezing paralysis.The economy has already given some signals of weakening, mostly through surveys showing increased pessimism. And a widely followed collection of real-time indicators compiled by the Federal Reserve Bank of Atlanta suggests the US economy may already be shrinking.Asked over the weekend whether he was expecting a recession in 2025, Trump told Fox News Channel: "I hate to predict things like that".

Tomatoes imported from Mexico are for sale in a supermarket in Miami as the United States imposed 25% tariffs on goods from Canada and Mexico, starting a trade war with its closest neighbors and allies Wednesday, Mar. 5, 2025. (AP Photo/Lynne Sladky) (AP)"There is a period of transition because what we're doing is very big. We're bringing wealth back to America. That's a big thing," he said."It takes a little time. It takes a little time."Trump says he wants to bring manufacturing jobs back to the US, among other reasons he's given for tariffs. His Treasury secretary, Scott Bessent, has also said the economy may go through a "detox" period as it weans itself off an addiction to spending by the government.The US job market is still showing stable hiring at the moment, to be sure, and the economy ended last year running at a solid rate. But economists are marking down their forecasts for how the economy will perform this year.

People work on the options floor at the New York Stock Exchange in New York, on Tuesday, March 4, 2025. (AP Photo/Seth Wenig)At Goldman Sachs, for example, David Mericle cut his estimate for US economic growth to 1.7 per cent from 2.2 per cent for the end of 2025 over the year before, largely because tariffs look like they'll be bigger than he was previously forecasting.He sees a one-in-five chance of a recession over the next year, raising it only slightly because "the White House has the option to pull back policy changes" if the risks to the economy "begin to look more serious"."There are always multiple forces at work in the market, but right now, almost all of them are taking a back seat to tariffs," according to Chris Larkin, managing director, trading and investing, at E-Trade from Morgan Stanley.The worries hitting Wall Street have so far been hurting some of its biggest stars the most. Big Tech stocks and companies that rode the artificial-intelligence frenzy in recent years have slumped sharply.Conservative podcast host named as FBI deputy director under TrumpView GalleryNvidia fell another 4.9 per cent Monday to bring its loss for the year so far to 20.2 per cent. It's a steep drop-off from its nearly 820 per cent surge over 2023 and 2024.Elon Musk's Tesla fell 8.7 per cent to deepen its loss for 2025 to more than 40 per cent. After getting an initial post-election bump on hopes that Musk's close relationship with Trump would help the electric-vehicle company, the stock has since slumped on worries that its brand has become intertwined with Musk. Protests against the US government's efforts to cull its workforce and other moves have targeted Tesla dealerships, for example.Stocks of companies that depend on US households feeling good enough about their finances to spend also tumbled sharply. United Airlines lost 8.3 per cent, and cruise-ship operator Carnival fell 8.2 per cent.

People work on the options floor at the New York Stock Exchange in New York, on Tuesday, March 4, 2025. (AP Photo/Seth Wenig)It's not just stocks struggling. Investors are sending prices lower for all kinds of investments whose momentum had earlier seemed nearly impossible to stop at times, such as bitcoin. The cryptocurrency's value has dropped back toward $US80,000 ($127) from more than $US106,000 ($168,000) in December.Instead, investors have been herding into US Treasury bonds as they look for things whose prices can hold up better when the economy is under pressure. That has sent prices for Treasurys sharply higher, which in turn has sent down their yields.