A new proposed tax cut would provide certain Australian couples a welcome hip-pocket sugar hit, but would make a taxation system that is in desperate need of meaningful reform even worse.Largely lost within the celebrations and protests on Australia Day, Pauline Hanson and One Nation put forward a new policy to help out couples with children.Under the proposal, those couples would be able to split their income evenly across their two tax returns, thereby reducing their combined tax bill by ensuring more income falls under the tax-free threshold and lower brackets.

Pauline Hanson has proposed a new tax cut, but the numbers don't quite stack up. (Alex Ellinghausen)"Income tax on a couple in which one person earns $120,000 and the other $30,000 is $31,709; under our proposal, they could split incomes evenly ($75,000 each) and save $2022," One Nation candidate Jennifer Game claimed.Her figures aren't, strictly speaking, accurate – they're based on 2023-24 tax brackets which have been changed, courtesy of the remodelled stage 3 cuts.While how much tax each person pays today is lower than what One Nation says, the real savings would actually be slightly higher: $2100 for the couple in Game's scenario.So does that make it good policy?"I don't think it has merit at all," Australia Institute chief economist Greg Jericho told 9news.com.au."It's been around for many years, the idea of income splitting… the main problem with it is it really just benefits high-income earners, and it also acts as a disincentive for mostly women to actually go into the workforce."The thing is, Australia does need new taxation policies – desperately so.It's now been more than 15 years since former Treasury secretary Dr Ken Henry handed down his comprehensive review of the tax system, which made 138 recommendations to overhaul it, making it fit for purpose for the 21st century.A mere handful of those recommendations were supported, and some that were ended up being repealed afterwards.EXPLAINED: When will the next federal election be held?

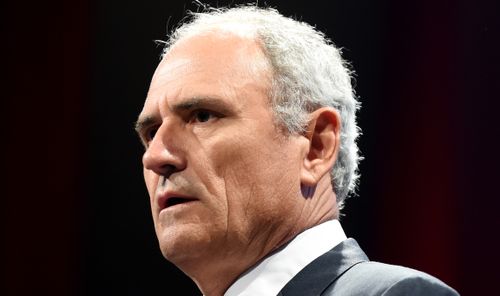

Ken Henry outlined how to reform Australia's tax system, but his recommendations are still gathering dust 15 years later."We're in a worse position now than we were 15 years ago… it's an intergenerational tragedy that we have allowed this to happen," Henry told the ABC last year.So what needs to change? For one, Jericho says handing out tax cuts to some couples isn't going to help."What we need at this moment is not less tax," he said."The way to reform the tax system is… to ensure that those who can afford to pay do pay a fair amount of tax, and also to remove these concessions and distortions, most of which go to the richest 10 to 20 per cent."The Australia Institute points to superannuation and capital gains as prime examples of generous concessions that need to be addressed, along with fuel tax credits, private trusts and luxury car exemptions for utes."But we also very much think companies, especially when we're looking at gas and mining companies, to make sure they pay their fair share," Jericho said."The petroleum resources rent tax (PRRT) is, to be honest, a joke."There are so many exemptions to it, so many ways that their tax lawyers can ensure that even on some of the world's largest LNG projects, they do not believe they'll ever have to pay any PRRT."

By international standards for developed countries, Australia is a low-taxing nation. (Louie Douvis)That all sounds like a lot more tax. But, contrary to popular opinion, Australia isn't actually a very high-taxing nation at the moment.According to a 2024 report, Australia has a tax-to-GDP ratio of 29.4 per cent.That's well behind countries that typically garner high scores in quality of living rankings, like Denmark (43.4), Finland (42.4), Norway (41.4) and Luxembourg (40.9), and comfortably below even the OECD average of 33.9 per cent.The same goes for income tax, which Australia is heavily reliant on."If you include all of the aspects of wages that are taxed across the OECD, we're still, again, one of the lowest taxed workers," Jericho says."Even if Australia was just to raise the average amount of tax of nations in the OECD, which is basically about how much Canada taxes, the government would raise about $135 billion extra a year."There's a lot that could be done with that money to help improve the economy, help reduce poverty, help improve services."

Increasing tax levels to the OECD average would raise an extra $135 billion every year. (AFR/ Luis Enrique Ascui)So is meaningful reform actually going to happen?There are few signs, if any, of it happening anytime soon, but last year's reworked stage 3 tax cuts provide cause for optimism, according to Jericho."There was a belief that would be political death if (Anthony Albanese) was to break that promise, but we certainly showed that stage 3 could be done in a way that not only was economically better, but politically popular," he said."I think it's really about actually mounting the argument…"If the government was to say, hey, we're going to reduce these tax concessions on the richest 10 per cent so that their superannuation balances isn't just a tax dodge, and that's actually going to enable us to, say, put dental care in Medicare, I think that type of argument is actually a political winner."But you need to have the courage and the gumption to do it, and hopefully the government or a political party will do it."