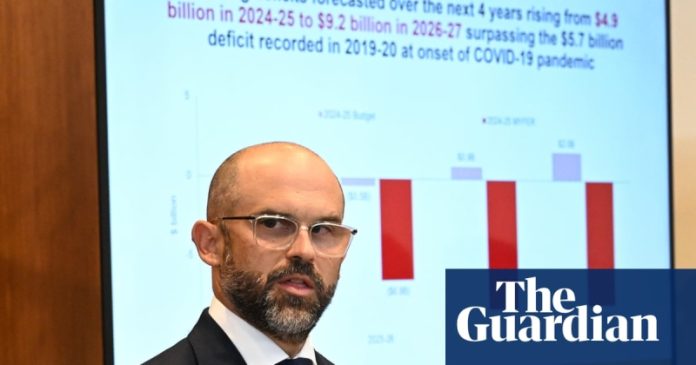

Releasing Mid-Year Financial and Economic Review, treasurer David Janetzki says significant cost blowouts caused by capital works overspend

Queensland’s credit rating is “highly likely” to be downgraded with the Crisafulli government’s first budget forecast predicting state debt will hit $218bn in four years.

The treasurer, David Janetzki, today issued the state’s mid year financial and economic review, the government’s first official budget update since taking government late last year.

He warned the state would go from the country’s least, to its most indebted, in just four years, blaming the previous Labor government for blowouts in infrastructure projects.

But he promised not to follow his predecessor’s policy of slashing thousands of public servants and selling assets to balance the books, saying “service delivery is paramount to our government”.

“Knowing what we know now, with debt per capita tracking to be the worst in the country, it is highly likely that we will not just have an outlook downgrade, but that it’s highly likely we’ll have a rating downgrade too,” Janetzki said.

S&P Global Ratings confirmed Queensland’s AA+ rating in September.

University of Queensland professor of economics John Quiggin said the budget update reminded him of former premier Campbell Newman and his commission of inquiry and “Strong Choices” asset sales program.

“You could pretty much have cut and pasted their report from 2012 to what we’re seeing today, and the same warnings of disaster and so forth and obviously we haven’t seen any sign of that disaster,” he said.

Quiggin said people “are rightly cynical” about new governments blaming their predecessor for budget blowouts as it is “more or less part of the standard theatre of these things”.

The new government accused its Labor predecessor of “deception”, claiming the budget would owe $46bn more by 2027-28 than the previous government estimated it would by that date.

Much of the blowout is caused by the state’s Big Build capital program.

The LNP claims it will cost $129.9bn of expenditure over the forward estimates – $22.6bn more than forecast by Labor.

It claims this is due to “significant cost escalations” in the capital program, the impact of the program on the capacity of the construction sector and workplace agreements with unions.

They also blame the “magnitude and pace of the former government’s Queensland Energy and Jobs Plan”, the plan for 75% renewables by 2035.

“It is a serious challenge to get the operating balance back into surplus, but it is a challenge we’re up for,” Janetzki said, on Thursday.

“We are committed to delivering the services that Queensland needs, and we need more nurses and teachers and police officers and firies – we need more of those frontline services, because Queensland deserves more and better services.”

Janetzki vowed not to cut operation expenditure, raise taxes, or sell assets and promised to borrow less than Labor would have – $217.8bn.

He didn’t answer a question as to whether the government could afford its planned capital expenditure.

And he wouldn’t be drawn on how much debt reduction he thought was appropriate, or how he would achieve it.

“I believe there will be more savings over time with respect to those large-scale projects,” he said.

Revenues from coal royalties – a major source of state revenue – are also forecast to go into precipitous decline, driving the budget further into deficit.

It is forecast to decline from a peak of $10.521bn in 2023-24 to just $4.5bn in 2027-28.

The LNP has promised to maintain the previous state government’s progressive royalties program.

The decline is due to a reduction in the coal price per tonne.

The state government has also continued its predecessor’s practice of offering a 2.5% wage increase to public servants.

Quiggin said there was little way for the government to save money without substantially reducing services and it was unlikely to adopt recommendations such as increased land tax.

Former Labor treasurer Cameron Dick said the government was “cooking the books to create the worst possible set of numbers to soften up Queenslanders for what comes next” – cuts to infrastructure projects.

The shadow treasurer, Shannon Fentiman, said the budget update included $23bn in additional unexplained spending, and slashed $3bn in savings planned by Labor.

“They have juiced up these figures so much that they may have put the state’s credit rating at risk. They’ve gone too far this time, and it’s just not credible,” she said.

The full budget is due in June.