Builder Joey Pamment is the director of Pamment Projects (ABC News: John Gunn)

In short:

Australian small to medium enterprises expect the cost of doing business to rise this year, with stubborn inflation and a tight jobs market.

A NAB survey found 22 per cent of businesses expect to see profitability decrease over the next year.

What's next?

The prospect of an interest rate cut or two is expected to boost consumer sentiment and business demand.

Inflation, global uncertainty and a tight jobs market are making conditions tough for Australian businesses and many are expecting it to get worse before it gets better.

Builder Joey Pamment's work has slowed by up to 75 per cent compared to the COVID years, when the construction industry was booming.

"It's a tough time to be a builder," he told the ABC.

"When we were booming, we were getting two to three inquiries sometimes a day, or at least a week," Mr Pamment, the director of his eponymous building company, said.

"At the moment we maybe get inquiries once a month, or every second month."

Customers were feeling the impacts of cost of living pressures and were delaying or scaling back projects, he said.

"A lot of the inquiries are dead leads, where you put the price in and the price is so exorbitant the client doesn't go ahead with the project."

Builders say construction costs have skyrocketed. (ABC News: John Gunn)

The most recent national data showed the pipeline of unfinished residential construction work has risen to a record high, while the number of dwellings under construction continued to fall — which investment bank UBS said was likely due to the rising cost of completing existing projects.

Mr Pamment has seen prices driven up by the high cost of construction materials and a skilled labour shortage. While high end projects were still going ahead, smaller projects had stalled.

As a small business owner, there were only so many ways he could cut costs.

"I think a lot of people put a lot of blame on the builders… but it's a tough time to be a builder — we're just passing the costs on to the client from the materials," he said.

Skilled labour has also been in short supply, making good talent scarce and more expensive.

"When you need to get a key trade, say a plumber or electrician, you need to have someone that's reliable for the project, and their price is normally more increased…than your standard sparkie or plumber."

Workers pour cement at a Bondi construction site. (ABC News: John Gunn)

Economist Leonora Risse from the University of Canberra said the labour market was still strong by historical standards despite a slowly rising unemployment rate.

"The Australian labour market is still very steady, very resilient, very strong.

"We're talking about an unemployment rate that's still just ticked over 4 per cent, so still historically very low and very high labour force participation rate," Ms Risse noted.

'There's a lot of pressure': businesses face tough times

The construction industry isn't alone in feeling the heat — a new survey by NAB found three-quarters of small to medium sized enterprises expect the cost of doing business to go up in 2025.

Just 2 per cent anticipate lower operating costs.

The survey found business confidence is waning, with 22 per cent of businesses expecting to see profitability decrease over the next year.

18 per cent foresee the amount of suitable labour decreasing and 16 per cent expect a fall in customer demand.

The tough economic conditions mean many businesses haven't made it — data from corporate regulator ASIC showed insolvencies at a record high.

Over 10,000 insolvencies have already been recorded for the current financial year, while a record 14,000 were recorded for the whole of the previous financial year, and 10,000 for the year before that.

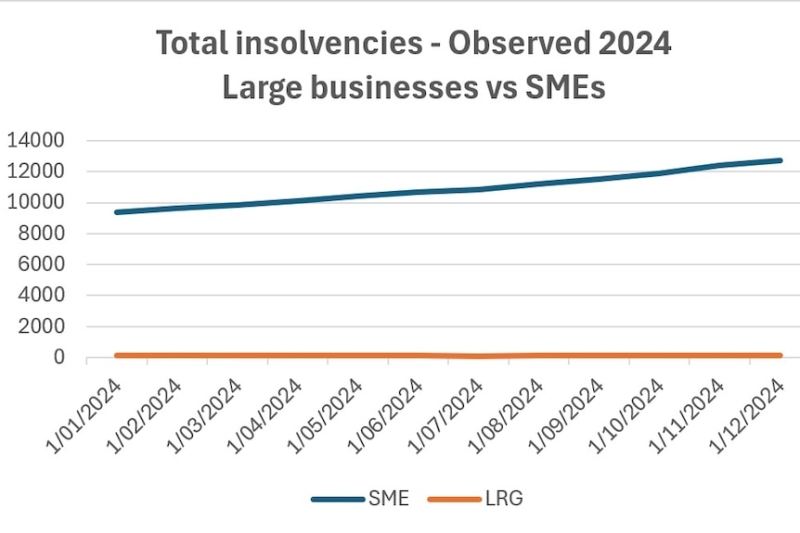

Similar data from CreditorWatch showed the failure rate for small to medium enterprises was much greater, and increasing, compared to larger businesses where the rate has been flat.

Insolvencies for small to medium enterprises (SMEs) have grown faster than for larger companies (CreditorWatch)

"SMEs are more vulnerable to economic downturns than large businesses for a number of reasons, such as having much smaller cash buffers to rely on and being less able to take measures to reduce costs such as cutting staff," a spokesperson for CreditorWatch told the ABC.

CreditorWatch has forecast the rate of insolvencies to increase across 2025, "at least until the impacts of one to two rate cuts have increased consumer confidence", though they noted inflation and interest rates appear to have peaked.

It's a trend builder Joey Pamment has noticed, with his company taking a hit from numerous subcontractor insolvencies.

"We're still feeling it," he told the ABC.

"We've had projects where the joiner has gone broke, the plumber has gone broke, and that puts pressure on us, because we lose money out of pocket if we have to get a new trade, a new subcontractor.

"We have lost money many times in the last couple years with insolvencies."

Mr Pamment has made a number of changes to protect his business in the event a subcontractor went bust mid-project, such as building up a contact base of reliable subcontractors.

He said Pamment Projects was also changing their approach by locking in costs at the beginning and discussing everything with the client "so the cost can be agreed on early before they start designing so the design doesn't get too elaborate".

"We spend a lot of time these days with cost savings and ways to do stuff better," he said.

NAB's top business banker said she believed insolvencies peaked in November of 2024.

"About three quarters of businesses say they do expect the cost of doing business to go up next year," said Rachel Slade, NAB's group executive of business and private banking. (Daniel Fermer)

"That, no doubt, is a little bit of a hangover from COVID, where lots of small businesses had government support," Rachel Slade, the bank's group executive of business and private banking, said.

"We also didn't have the ATO chasing businesses as hard for outstanding tax debt, and that's certainly accelerated over the last six months, and that's starting to show up in the in the insolvency numbers."

Businesses innovating to save money

For vertical farmer, Tyrone Dickson the tough economic conditions are reminiscent of his first year in business.

"Being a business owner at the moment is quite tough and it's not too dissimilar to our first year, 2020.

"We are moving into uncertain times again, but that doesn't mean that we can't combat this using processes and technology to be able to continually keep performing against the market."

His company April Sun grows plants like microgreens in a warehouse in the inner Melbourne suburb of Thornbury.

April Sun co-founder Tyrone Dickson says they have reduced their energy use by 40 per cent, in an effort to cut costs. (ABC News: Nico White)

"Inflation is an issue and there's a rise in cost materials that's also problematic for our business, and so the only way that we can really deal with this is that we apply scale to our operations."

Their major concern this year was reducing costs: "And for us the major cost is energy. So energy consumption, we tried to drive that down through our proprietary technologies that we've developed and our climate control system."

He said they have reduced their energy use by 40 per cent, compared to what a conventional greenhouse would use.

Other ways they have planned to save costs in the future are through more automation and better technological advances.

Many businesses have turned to innovative technologies to save money, said Ms Slade.

"The thing with Australian businesses is that those business owners, they're essentially entrepreneurs at heart, so they're always looking for ways to counter the challenges."

Rate cuts a light on the horizon

While the economic outlook isn't overly rosy, it's not all doom and gloom, with businesses saying the expectation of a rate cut or two was a small but bright glimmer on the horizon.

NAB's Rachel Slade expected conditions to improve in the second half of the year, with the federal election over, the benefits of tax cuts flowing through and an interest rate cut widely expected to be delivered.

"Of course, that's good for businesses, but also I think that is what's buying their optimism around consumer demand, because they expect consumers to be spending more," said Ms Slade.

What's going to happen to the economy in 2025?

Photo shows A graphic of President Xi Jinping and President Trump in front of picture of the Chinese and US national currency.

Joey Pamment believed a rate cut would give customers and businesses more certainty.

"I definitely think that you will be getting more calls and more inquiries on projects, and a lot of projects that we may have priced last year that were put on hold will go ahead."

Mr Dickson from April Sun said they were feeling positive about the year ahead.

"With the interest rate cuts, we expect the discretionary spending of the consumer to actually go up, and with that being the case we expect that to have a flow on with our business and we should see higher sales.

"Our business outlook for this year is that we're actually going to be looking at investors and scaling our farm… we're actually going to be hiring more labour," he said.

Darren Nichol and Tyrone Dickson co-founded April Sun Farms, which produces microgreens in Melbourne. (ABC News: Nico White )

Similarly, NAB's Rachel Slade said their survey found not many small to medium enterprises were planning to cut staff.

"Our businesses are telling us about a third of them are planning to increase their workforce over the next year, and of the remaining two thirds, most of them are planning to keep their workforces about the same size."

However, economist Leonora Risse said the uncertainty was set to continue with rising geopolitical instability.

"If you are a small business and you're trade-exposed and you do rely on imports… the nosedive in the Australian currency is an example of the type of volatility that you're going to have to navigate.

"On the other hand, if you are export-oriented, you're in the tourism industry, then those fluctuations in the Australian currency can sometimes serve you quite favourably as well," Ms Risse noted.

"As always, that global picture always presents uncertainty. But given the geopolitical changes that we've seen recently, that's probably an even bigger question mark at the moment."