Heartbroken business owners have explained why they believe so many small Australian companies went bust this year. and the hospitality, construction and retail industries were among the worst hit as inflation drove costs up.Plenty of small and large business owners made the gut-wrenching decision to shut doors or were forced to liquidate as they drowned in bills, including Sydney woman Belinda Jane Keehn.

Belinda Jane Keehn ran her own business, BJ's PJs, but couldn't afford to keep it going in 2024. (Supplied)She told 9news.com.au she folded her clothing business, BJ's PJs, this year after struggling to cope with the aftermath of COVID-19."When I launched my business just six years ago, the world was very different," Keehn said."Unfortunately, this year, after years of navigating the challenges of small business ownership, including the aftermath of COVID-19 and skyrocketing living costs, I made the difficult decision to close my doors. "The rising production costs, financial stress, and declining consumer spending have made it unsustainable to continue."Keehn said the cost of production meant she was barely making any profit from her brand.She also blames the big brand competition which made it virtually impossible to match prices.

She said the rising cost of production meant she couldn't turn a profit. (Supplied)"I am far from alone in these challenging times," she added."Many small businesses are either closing or are on the brink of doing so, and it's heartbreaking to witness."Keehn said the cost of fabric, manufacturing and postage resulted in her business effectively being made "non-profitable"."Winding down has been an emotional and difficult challenge," she said."I Have built up my clientele in my other small business, Keehn As Gardening and Light Home Maintenance, which took a back seat to BJ's PJs over the last few years but will focus more on that to supplement the loss of income."The best and worst states and territories to try and run a business inView GallerySydney man Mick Owar ran his own construction business for five years.He told 9news.om.au business boomed after he started it in 2018, but things went south post-COVID."The cost of materials just exploded and there was a point after COVID where the labour force just woke up and didn't want to work anymore," he said."Finding people that just had an ounce of reliability became almost impossible."Owar described the taxes forced on businesses in Australia as a "joke".This contributed to Owar shutting down the construction side of his company after realising he was barely able to cut himself a salary.

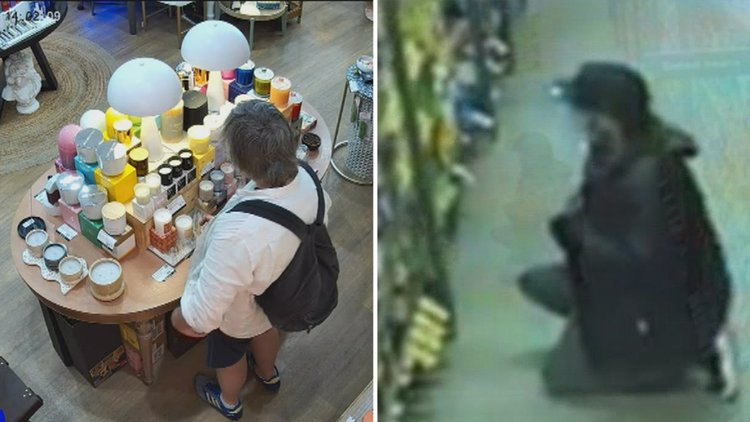

Experts have blamed the huge spike in business failures in rising costs, tax debts and low consumer spending. (Dion Georgopoulos/SMH)According to UNSW research, rising material costs, tax debts and high interest rates have contributed to the surge of businesses going bust this year.Low consumer spending has also been a major factor."The more discretionary categories of spending tend to get cut back on, and for businesses in that sector, a large and sudden drop in demand can make it economically impossible to continue," Professor Richard Holden from the UNSW School of Economics said.In October, a report from CreditorWatch found businesses in Australia were collapsing at a rate not seen since the pandemic.It blamed the rapid rate of business owners shutting doors on the cost of living crisis and mounting tax debts.CreditorWatch noted all sectors have seen a major spike in failures since the ATO ramped up collections in October 2023.