Countries including Vietnam could benefit from US tariffs levelled against China. (Reuters: Khanh Vu)

In short:

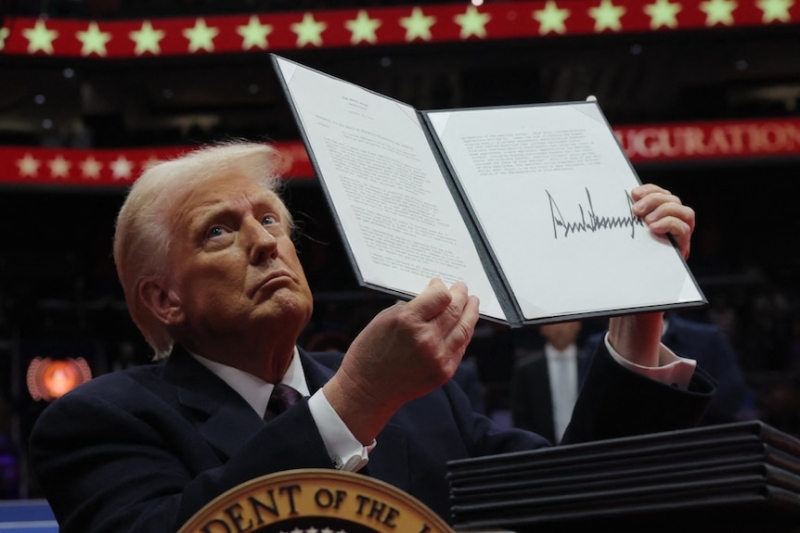

China was slapped with 10 per cent tariffs by the new Trump administration.

A mix of trade tensions, COVID-19 and shutdowns have already led many firms in China to set up shop in South-East Asian nations.

What's next?

Experts say the complexity and cost of moving production, as well as questions over further US sanctions, could slow potential moves into South-East Asian markets.

As forewarned, US tariffs against China have come into force, and now the global trade landscape is bracing for a reshuffle.

"Think of it as a big game of global trade musical chairs," Justin Wolfers, from the University of Michigan, said this week.

"If there was any country that was really going to face the ire of the president, it was China."

US President Donald Trump this week slapped 10 per cent tariffs on China — significant, but much lower than the 60 per cent he had threatened.

While US neighbours Mexico and Canada were able to leverage eleventh-hour reprieves from the 25 per cent tariffs levied against them, China responded with its own suite of levies on US goods, fuelling a trade war.

Mr Trump's first presidency and trade tensions with China saw an exodus of international and Chinese companies to South-East Asia — a trend that was also spurred by the COVID-19 pandemic and subsequent shutdowns.

Diversifying away from China, a slew of new factories opened in countries including Vietnam, Thailand, Malaysia, Indonesia and Cambodia.

As Mr Trump's second term begins, what could that mean for global trade in the region?

Which countries could benefit?

Geopolitical factors impacting global trade are nothing new.

When it comes to gauging what impact the tariffs may have, experts warn this space is highly unpredictable.

International law firm Baker Mackenzie wrote that some multinational companies were "quiet quitting" China and Mexico to try and offset the impacts of tariffs, while others were shifting some, but not all, of their production to diversify.

"The imposition of tariffs by President Trump has undeniably reshaped the landscape of global business," it said.

Chinese EV company BYD opened its first factory in Thailand last year. (Reuters: Chalinee Thirasupa)

Firms in China are definitely diversifying, according to Deborah Elms, head of trade policy at the Hinrich Foundation in Singapore.

"Chinese exports to the rest of the world continue to skyrocket, including to places like in Africa [and] Latin America, where there wasn't a lot of Chinese penetration earlier," she said.

"Firms are very entrepreneurial, especially firms out of China because it's cut-throat competition — if you survive in China, you can survive anywhere. And so they're very good at finding a market niche that works for them."

Deborah Elms says some companies moved out of China to Mexico during the previous Trump administration, but may face fresh tariffs there. (Supplied)

Sports fashion brands including Nike, Adidas and Puma have made the jump to Vietnam — which was considered one of the major beneficiaries of the last US-China trade war. Vietnam is also expanding its manufacture of electronics.

Malaysia, a strategic logistics and shipping hub, offered competitive labour costs and also benefited from the US-China chip war, Baker Mackenzie wrote, adding some firms chose to relocate their data centres there.

Recently, Chinese electric vehicle factories have opened in Thailand amid tariff pressure from the US as well as the European Union.

Shoemaker Steve Madden was an example of a company looking to alternative countries, including Cambodia, Vietnam, Mexico and Brazil, amid US tariff woes.

China retaliates with tariffs on US goods after Trump imposes new levies

Photo shows close up of china president xi jinping and US president donald trump

Dr Elms said that pattern was likely to continue under this Trump administration.

And while some countries stood to benefit, Jayant Menon, a senior fellow at Singapore think tank the ISEAS Yusof Ishak Institute, warned there were downsides too.

"The escalation in the US-China trade war involving an additional 10 per cent tariff is likely to adversely impact exports from China, inflation in the US, and indirectly the economies of South-East Asia through supply chain links," he said, adding that the electronic supply chain in the region was still centred in China.

"The tariff will reverberate throughout the supply chain, resulting in a drop in output and employment in all countries involved."

And this time around, there are additional complexities.

Questions of origin

Dr Menon said Mr Trump was likely to continue the trend that started with the recent measures announced by former president Joe Biden, which targets ownership and nationality rather than location of firms.

"If these measures continue or increase, then they will mainly be negative spillovers on the South-East Asian region," he said.

China imposed tariffs on US imports in response to Donald Trump's tariffs on China. (Reuters: Carlos Barria)

Dr Elms said if there were Chinese content or raw materials in products made in a third country, they might now be subjected to tariffs.

"This is not something we've done before. It would be incredibly expensive for compliance purposes, but I think it's ahead," she said.

That complexity could slow down firms that would otherwise expand into other markets, she said, and might force some to question whether they want to continue exporting to the lucrative US market at all.

"What I think is the more likely outcome of all of this tariff chaos in the first two weeks of Trump is more and more firms are going say, 'Is it worth it?'"

"The chaos, the changes, the compliance costs and increases — it's not worth it anymore."

Increasing labour costs

Vivienne Bath, a professor of Chinese and international business law at the University of Sydney, said the prospect of tariffs did not tell the full story.

Companies diversifying was "in part due to geopolitics, the trade war, or anticipated trade war, but also to deal with future de-coupling of supply chains, difficulties with Chinese government policies and regulations", she said.

Another factor influencing this space is competition when it comes to wages.

"The cost of labour has risen in China [and there are fewer young people coming through to feed the factories], so these are factors on top of the insecure US trade relationship," she said.

"So it is not clear whether 10 per cent tariffs would make a big difference to the decision to set up offshore facilities, though it could be a factor. Moving production is expensive and getting it up to speed is time-consuming."

Trade tensions and the pandemic saw a shift in global supply chains. (Reuters: Cindy Liu)

Khun Tharo, program manager at the Cambodian Centre for Alliance of Labor and Human Rights (Central), said the country had seen a lot of investment from China over the past two decades.

"There's an opportunity for Cambodia to take advantage from that shifting of the production," he said, especially in the garment, footwear and travel goods sectors.

"The infrastructure is here, the facility is here."

How Australia will be caught up in Trump's trade war

Photo shows A man wearing a suit and red tie caps a black pen lid onto a marker after signing a document.

But he added the country was still heavily reliant on raw materials from China, Vietnam and Indonesia.

Another issue, he said, was that Cambodia did not always have leverage to make companies accountable to respect labour rights.

"The problem is about possibility or sustainability in the future," he said.

"We don't know what's going to happen in the next couple of years."